When we comes to anti-Dumping, we need to know what dumping is first.

Dumping is a process wherein a company exports a product at a price that is significantly lower than the price it normally charges in its domestic market. Because dumping typically involves substantial export volumes of a product, it often endangers the financial viability of the product's manufacturer or producer in the importing nation.

The government imposes anti-dumping duty on foreign imports when it believes that the goods are being "dumped" – through the low pricing – in the domestic market. Anti-dumping duty is imposed to protect local businesses and markets from unfair competition by foreign imports.

The duty is priced in an amount that equals the difference between the normal costs of the products in the importing country and the market value of similar goods in the exporting country or other countries that produce similar products. The anti-dumping duty can be anywhere from 0% up to 550% of the invoice value of the goods.

Different countries will define whether anti-dumping is required for different products. Then how can we know it’s an anti-dumping to the USA, Canada, UK or other country? Let’s share the easy way below.

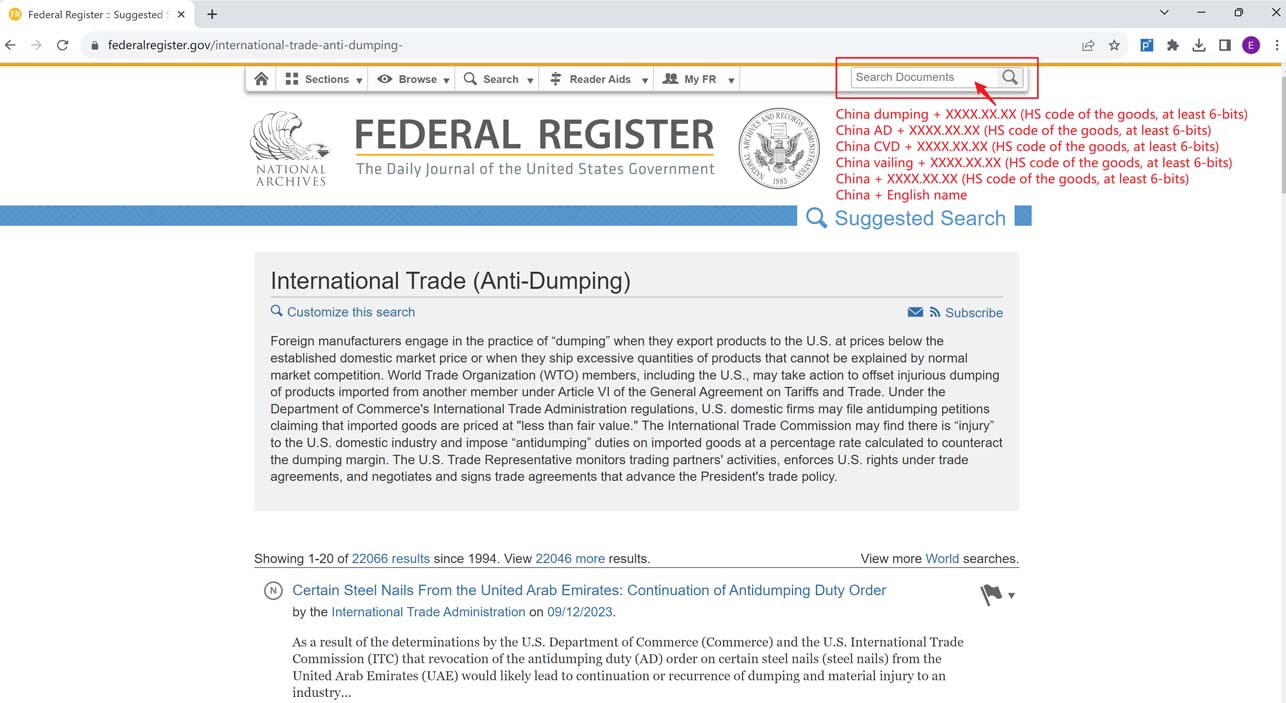

USA

https://www.federalregister.gov/international-trade-anti-dumping

Step 1: Open the website above.

Step 2: Prepare the info. of your goods.

China dumping + XXXX.XX.XX (HS code of the goods, at least 6-bits)

China AD + XXXX.XX.XX (HS code of the goods, at least 6-bits)

China CVD + XXXX.XX.XX (HS code of the goods, at least 6-bits)

China vailing + XXXX.XX.XX (HS code of the goods, at least 6-bits)

China + XXXX.XX.XX (HS code of the goods, at least 6-bits)

China + English name

Step 3: Enter the keyword combination query in the upper right corner field as shown in the figure:

Step 4: The combination keyword of step 2 can search for a variety of results, including but not limited to: notice of anti-dumping investigation, notice of ruling that the product is anti-dumping, notice of formal release of anti-dumping order, notice of expiry review of anti-dumping order, and renewal of anti-dumping order notifications and more. Click to check more details about it.

Note: This query method requires multiple combinations of queries to avoid omissions!

Example: Using "trolley" as an example to query anti-dumping

Step 1: open the website.

Step 2: Using China + English name to check.

China Trolley

Step 3:

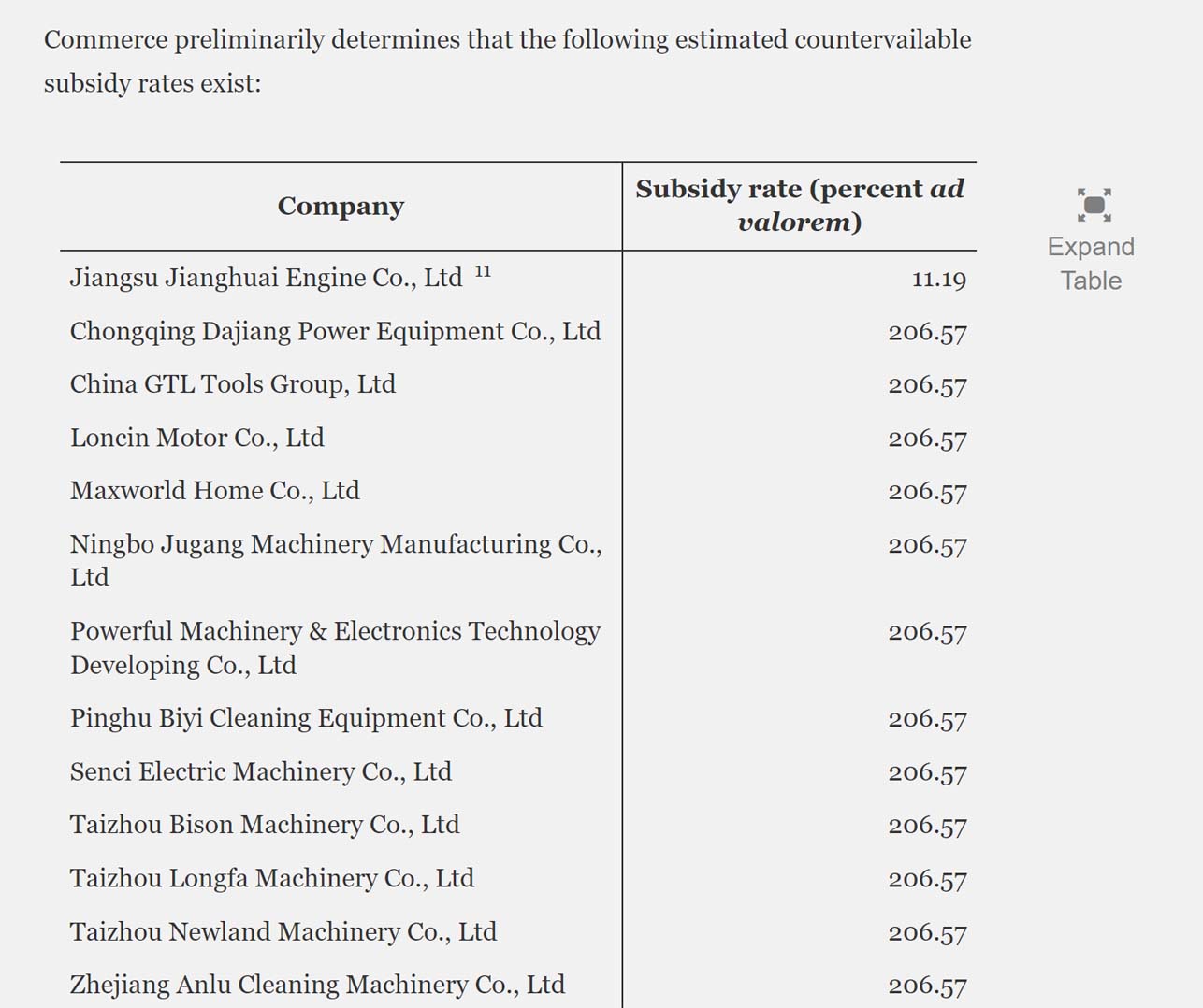

In the query result, find the notice of the official issue of anti-dumping order, click on the anti-dumping product scope and anti-dumping tax rate.

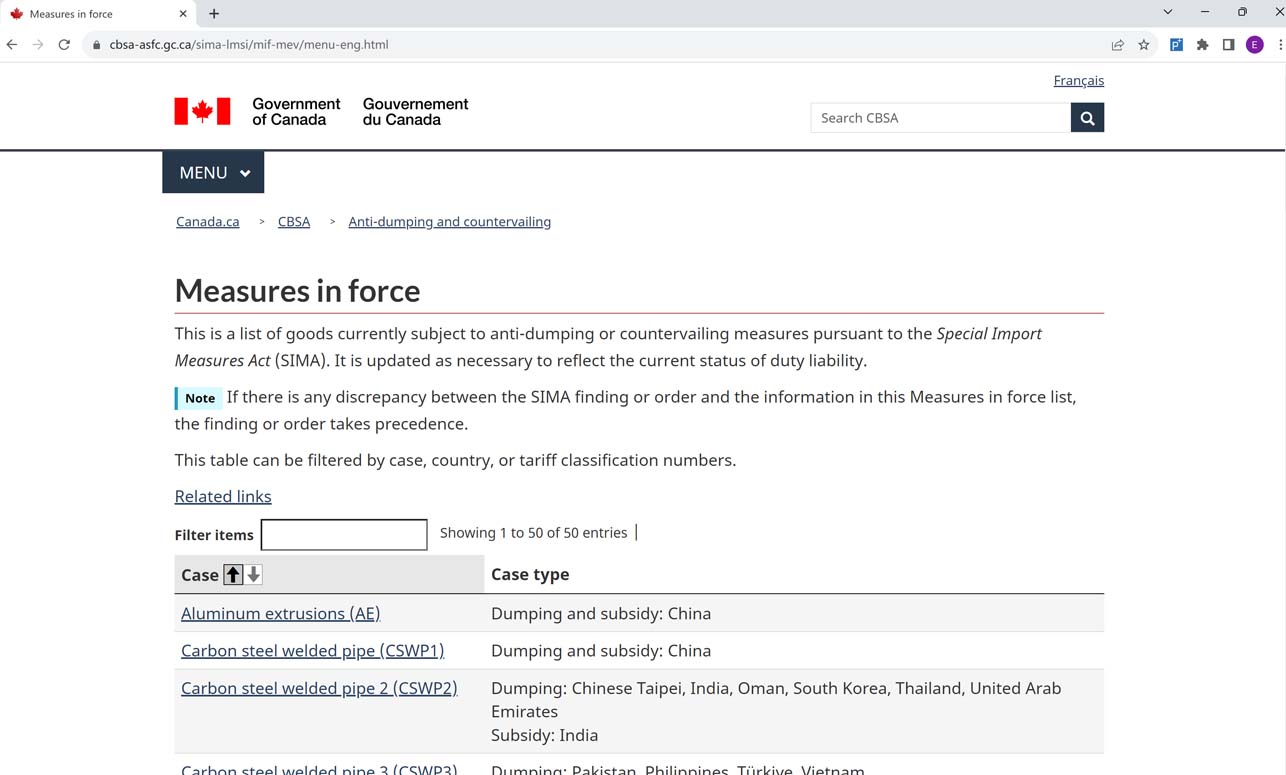

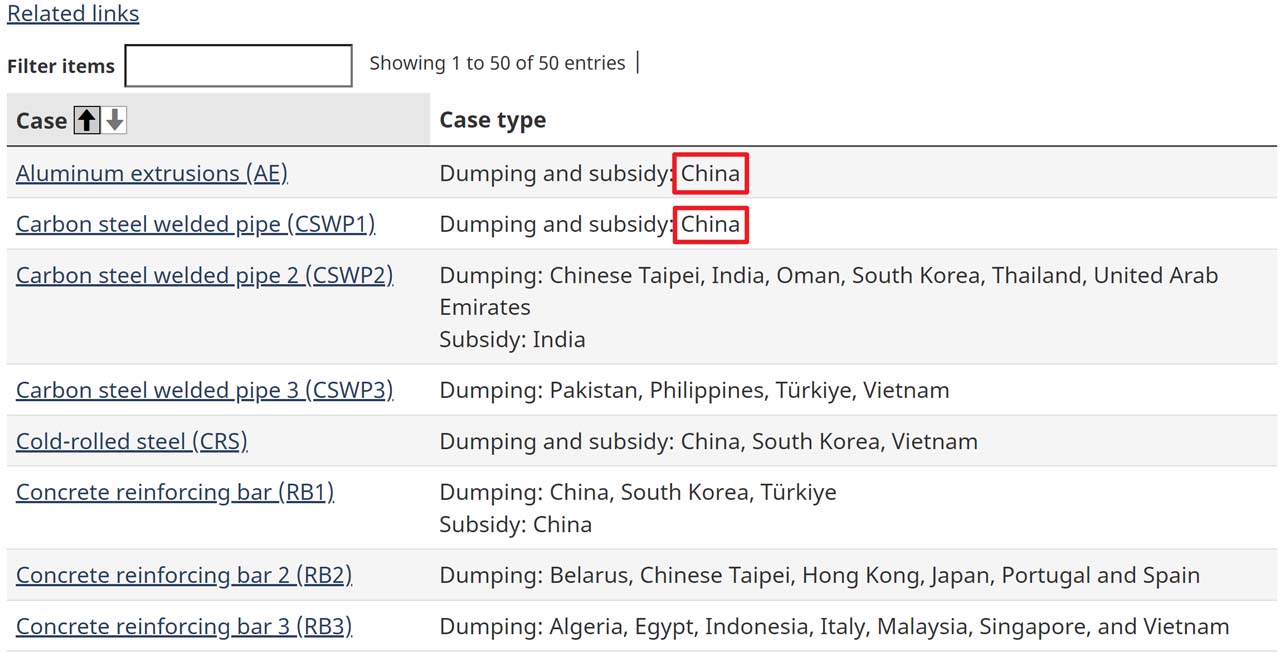

Canada

https://www.cbsa-asfc.gc.ca/sima-lmsi/mif-mev/menu-eng.html

Step 1: Opening the web page displays a summary table of anti-dumping products from all countries to Canada. If "China" is displayed in the "Case type" column, it means that this product is subject to anti-dumping in China and Canada.

Step 2: Click on the product name in the "Case" column, and you can see the anti-dumping product range and anti-dumping tax rate. Canada also has tax rates for specified and unspecified exporters. Such exporters will be included in the notice of the final ruling. The independent anti-dumping tax rate, the unspecified exporter’s anti-dumping tax rate is shown in the red box in the figure:

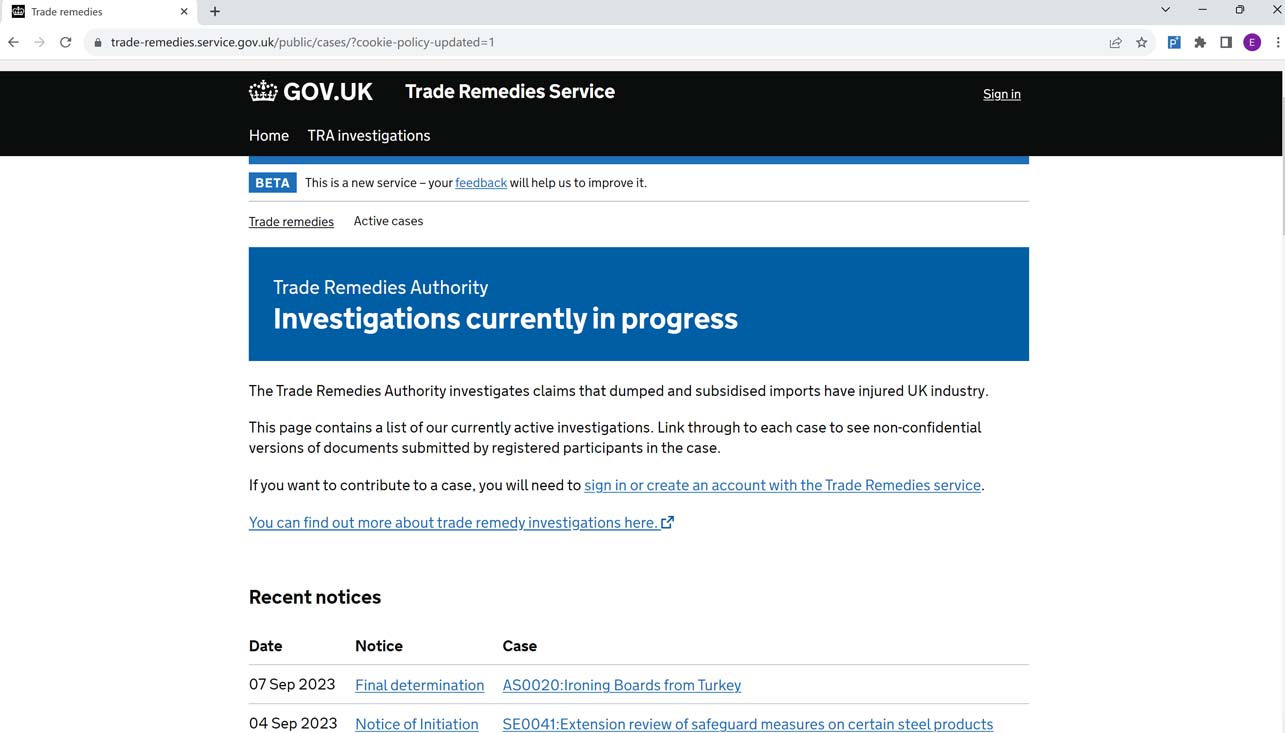

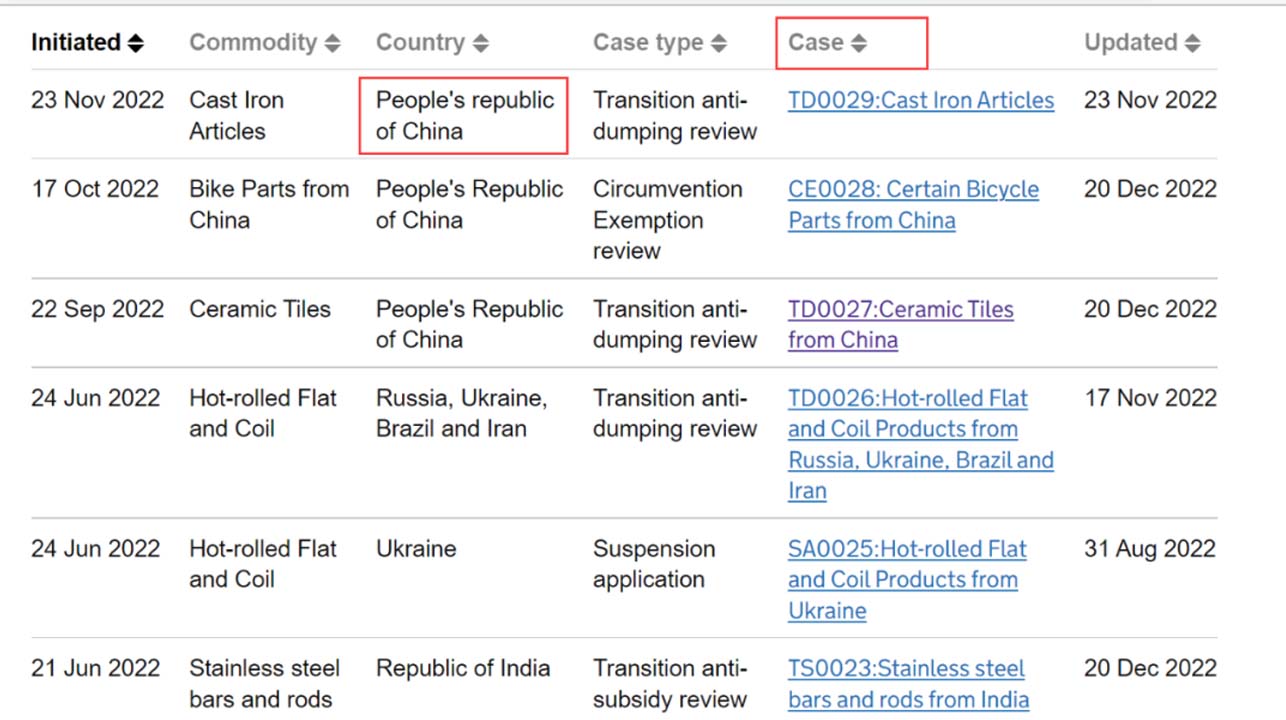

UK

https://www.trade-remedies.service.gov.uk/public/cases/

Step 1: Opening the web page displays a summary table of anti-dumping products from all countries to the UK. If the "Country" column is "People's Republic of China", it means that this product is anti-dumping between China and the UK.

Step 2: Click on the Case column file to view information such as the anti-dumping scope and customs code of the corresponding product.

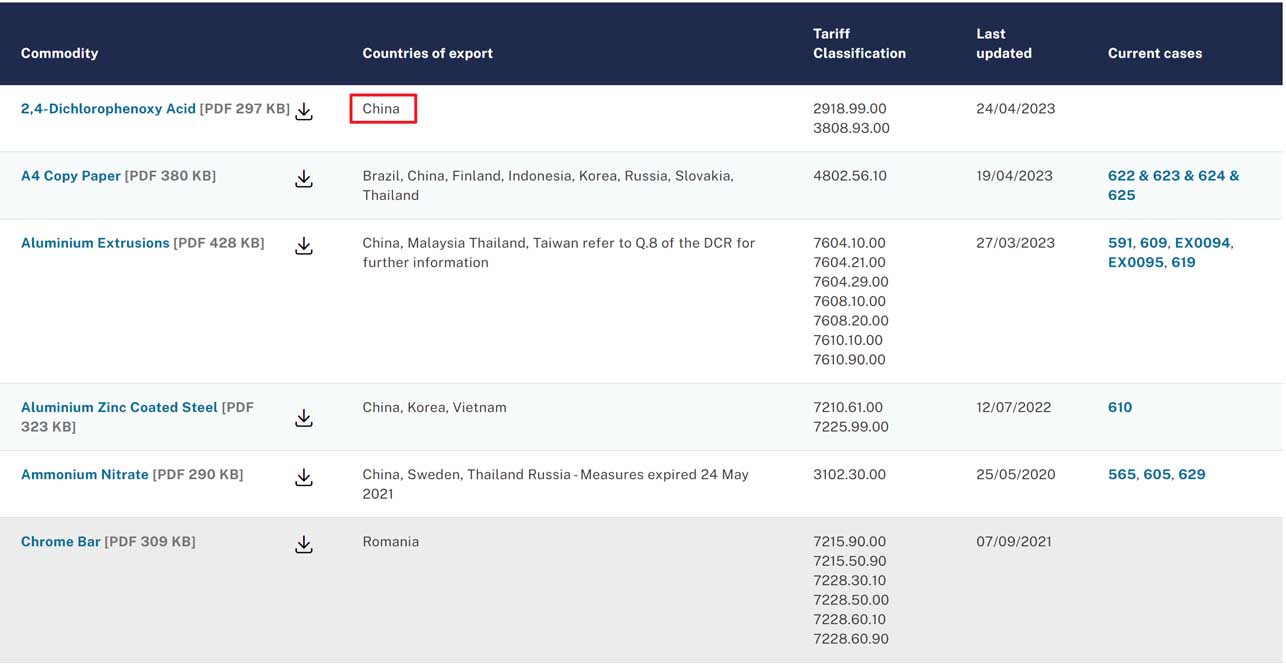

Australia

https://www.industry.gov.au/anti-dumping-commission/current-measures-dumping-commodity-register-dcr

Step 1: Opening the web page displays a summary table of anti-dumping products from all countries to Australia. The "Countries of export" column is "China", which means that this product is anti-dumping between China and Australia.

Step 2: Click the download icon with the downward arrow shown in the picture to download the specific anti-dumping measures including anti-dumping tax rates for the corresponding products.

The above is the query method for anti-dumping products in major overseas countries and regions. If you have any questions, please feel free to consult us!

Air Freight vs Sea Freight: Choosing the Right Shipping MethodApril 20, 2024In the realm of logistics, the choice between air freight and sea freight can significantly impact the efficiency and cost-effectiveness of transporting goods. Understanding the differences between th...view

Air Freight vs Sea Freight: Choosing the Right Shipping MethodApril 20, 2024In the realm of logistics, the choice between air freight and sea freight can significantly impact the efficiency and cost-effectiveness of transporting goods. Understanding the differences between th...view The 133rd Canton Fair Ended Successfully, And the On-Site Export Turnover Reached 21.69 Billion US DollarsMay 12, 2023On the afternoon of May 5th, the offline exhibition of the 133rd Canton Fair closed in Guangzhou, China, and the online platform was operating normally.According to Xu Bing, news spokesman of the Cant...view

The 133rd Canton Fair Ended Successfully, And the On-Site Export Turnover Reached 21.69 Billion US DollarsMay 12, 2023On the afternoon of May 5th, the offline exhibition of the 133rd Canton Fair closed in Guangzhou, China, and the online platform was operating normally.According to Xu Bing, news spokesman of the Cant...view GBATS Guangdong, Hong Kong and Macao Services Trade Exhibition & CCBEC Shenzhen Cross-border E-commerce Exhibition grandly opens with more than 2,000 exhibitors welcoming new business opportunitiesSeptember 18, 2023The opening ceremony of the GBATS Guangdong, Hong Kong and Macao Services Trade Exhibition & Shenzhen Cross-Border E-commerce Exhibition (CCBEC) were held at the Shenzhen International Convention ...view

GBATS Guangdong, Hong Kong and Macao Services Trade Exhibition & CCBEC Shenzhen Cross-border E-commerce Exhibition grandly opens with more than 2,000 exhibitors welcoming new business opportunitiesSeptember 18, 2023The opening ceremony of the GBATS Guangdong, Hong Kong and Macao Services Trade Exhibition & Shenzhen Cross-Border E-commerce Exhibition (CCBEC) were held at the Shenzhen International Convention ...view Attention please! Shanghai Port is closed due to heavy fog | Shipping company issues delay noticeApril 22, 2024Affected by the humid and warm air flow, heavy fog occurred in the areas along the Yangtze River Estuary in Shanghai on April 15. The visibility in the waters of the Yangtze River Estuary was less tha...view

Attention please! Shanghai Port is closed due to heavy fog | Shipping company issues delay noticeApril 22, 2024Affected by the humid and warm air flow, heavy fog occurred in the areas along the Yangtze River Estuary in Shanghai on April 15. The visibility in the waters of the Yangtze River Estuary was less tha...view