E-commerce becomes more and more popular around the world. The E-commerce has experienced significant growth in Australia recently as well. It will be a smart move expanding your business to reach your customers in Australia. What do we need to pay attention when marketing into Australia? You may concern the kinds of goods, shipping freight, stock in Australia. While you need to consider more on the cost of import taxes. Most of you may know little about the import taxes.

The Australian Border Force (ABF) are responsible for enforcing import tax laws, and if you can't or won't pay the import tax, generally they will seize and destroy your goods.

In severe offenses of import tax avoidance, the ABF have the authority to issue fines and even pursue criminal charges.

It's very serious. so, let's talk detail about the taxes and duties in Australia today.

What is the import taxes in Australia?

The two main taxes levied on imports to Australia are:

GST: Goods and Services Tax.

Customs duty.

GST on imports is payable by the importer of the goods at the same time and in the same manner as customs duty is paid. GST rate is calculated at 10% of the value of the taxable importation.

The value of the taxable importation include below detail:

1. The customs value of the importing goods.

2. The international transport charge and insurance charge of the goods.

3. Any customs duty payable in respect of the goods.

4. The LCT if any.

5. The WET if any.

GST may be a considerable expense, if your imports are large. But there is good news for you. You can claim a credit for the GST after filed BAS(Business Activity Statement). To learn more about claiming GST credits, you had better speak to a registered Australian Tax Agent or seek advice from the Australian Taxation Office.

The customs duty will vary depending on several factors, including the type of goods, the original country, HS code, and the value of the goods.

Generally, most general cargo attracts a standard rate of 5% import duty based on FOB value.

However, it's not all goods are subject to customs duty in Australia. Many countries have several free trade agreements with Australia that can reduce or eliminate customs duty on certain goods.

You should consult and hire a freight forwarder or a customs broker to help you to ensure compliance with customs regulations and to accurately calculate the customs duty payable on your imports.

Some special goods may also be liable for other more niche taxes, such as the following:

The LCT (The Luxury Car Tax)

The luxury cars imported into Australia is applied to be charged at the rate of 33% on the amount.

The WET (The Wine Equalisation Tax)

The wine import into Australia, you will generally have to account for WET. It is a tax of 29% of the wholesale value of wine.

When are taxes charged?

The taxes have to be paid before your goods are released. Usually, your freight forwarder will note you to pay the taxes. You should make the payment in time. If you failure to pay it, your goods will be seized, possible destroyed, and other penalties. If the goods is hold in customs because of payment late, you have to pay extra warehouse cost before released, or you won’t get the goods.

What documentation do you need importing to Australia?

In our experience, having an ABN is very important for customs clearance in Australia. ABN is Australian Business Number. It easier to comply with Australian import regulations.

Without an ABN, customs clearance will be laborious and potentially cause you to incur storage charges at port while customs is processing.

What exemptions apply when goods from China?

Australia have free trade agreements(FTAs) with China as well. It is ChAFTA which entered into force on 20 Dec. 2015. In fact, ChAFTA eliminated tariffs on the vast majority of trade in goods.

· Step 1: Identify the tariff classification of your goods.

In ChAFTA, goods are identified by reference to an internationally-recognised system known as the Harmonized Commodity Description and Coding System, commonly referred to as the Harmonized System (HS). The HS is a common goods classification system of more than 5200 six-digit product categories.

Typically, countries further sub-divide the six-digit HS product categories into eight-digit or more tariff lines for greater specificity. (Australia and China both use eight-digit tariff codes for customs duties).

To be certain that you have identified the correct tariff for your good, we recommend that you consult a professional customs broker or freight forwarder like CUC International Freight.

· Step 2: understand how your goods will be treated under ChAFTA

Once you have the tariff code, you can determine how your goods will be treated under ChAFTA. Both China and Australia have set out their commitments to reduce duty rates on goods in lists, called tariff schedules. It is searchable by key word or HS code, and contains tariff rates for both imports and exports. The FTA portal also contains information about whether your product is likely to meet Rule of Origin (ROO) requirements.

· Step 3: Determine whether your goods meet Rules of origin requirements.

ChAFTA preferential rules of origin (ROO) are agreed criteria used to ensure that only goods originating in either China or Australia enjoy the benefits of the Agreement. These rules prevent goods from a third party being transshipped through either China or Australia to take advantage of the FTA to access lower, preferential import tariffs. Any imports into China or Australia that do not comply with the ROO will be subject to the general (MFN) rate of duty, instead of the preferential rates available under ChAFTA.

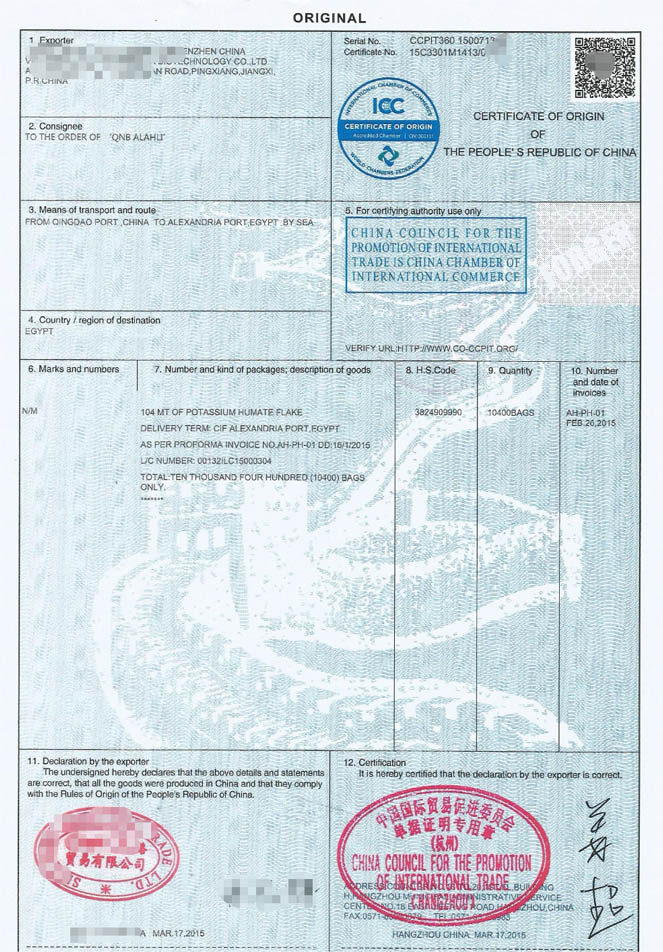

· Step 4: Prepare a certificate of origin for your goods

Once you have gone through the first three steps and determined that your good will qualify for preferential tariff treatment under ChAFTA, you will need to complete the appropriate documentation to demonstrate this, should you be asked, to the importing customs authority. This can be done by using a ChAFTA Certificate of Origin (COO), or Declaration of Origin (DOO).

Certificate of Origin: A COO must be issued by an authorised body in the country of origin and may need to be provided, on request, to customs officials in the importing country. Usually, your freight forwarder can help you with it.

Declarations of Origin: Alternatively, an exporter or producer may choose to complete a Declaration of Origin (DOO). A DOO may be accepted in place of a COO, for goods covered by an advance ruling on ChAFTA origin.

Global Commerce Flow: Shipping Goods from China to CanadaMarch 13, 2024In the context of the globalized economy, the circulation of goods has transcended geographical boundaries, and international trade has become a crucial engine for economic development. As a world man...view

Global Commerce Flow: Shipping Goods from China to CanadaMarch 13, 2024In the context of the globalized economy, the circulation of goods has transcended geographical boundaries, and international trade has become a crucial engine for economic development. As a world man...view Air Freight vs Sea Freight: Choosing the Right Shipping MethodApril 20, 2024In the realm of logistics, the choice between air freight and sea freight can significantly impact the efficiency and cost-effectiveness of transporting goods. Understanding the differences between th...view

Air Freight vs Sea Freight: Choosing the Right Shipping MethodApril 20, 2024In the realm of logistics, the choice between air freight and sea freight can significantly impact the efficiency and cost-effectiveness of transporting goods. Understanding the differences between th...view What are Incoterms®?October 12, 2023The Incoterms is an abbreviation for “International Commercial Terms.” This term represents a very useful way of communication and it’s actually aimed at reducing confusion between buyers and selle...view

What are Incoterms®?October 12, 2023The Incoterms is an abbreviation for “International Commercial Terms.” This term represents a very useful way of communication and it’s actually aimed at reducing confusion between buyers and selle...view The 133rd Canton Fair Ended Successfully, And the On-Site Export Turnover Reached 21.69 Billion US DollarsMay 12, 2023On the afternoon of May 5th, the offline exhibition of the 133rd Canton Fair closed in Guangzhou, China, and the online platform was operating normally.According to Xu Bing, news spokesman of the Cant...view

The 133rd Canton Fair Ended Successfully, And the On-Site Export Turnover Reached 21.69 Billion US DollarsMay 12, 2023On the afternoon of May 5th, the offline exhibition of the 133rd Canton Fair closed in Guangzhou, China, and the online platform was operating normally.According to Xu Bing, news spokesman of the Cant...view