When importing into the US, you will be asked for providing an IRS or EIN number for the ultimate consignee. If you have hired a forwarder company to deal with the shipping tasks, experienced forwarders will ask you for this information in advance. While if you don’t, then, without warning, your goods may be stopped at the port of entry. This is the issue that you do not submit the importer info. on time. Done incorrectly, importing goods can have severe consequences including entry refusal, seizure of goods, and fines.

Curious, you may ask what IRS number is? Why do I need it? How and where can I obtain it?

Let’s dive into it a little deeper today.

What is IRS? Internal Revenue Services (IRS)

Internal Revenue Services(IRS) is a government agency that administers tax laws and collects federal taxes from U.S. individual and corporate taxpayers. The IRS issues the numbers directly to company or individual.

Employer Identification Number(EIN): Issued to business entities.

Social Security Number(SSN): Issued to individuals.

Why do I need an IRS?

We need to know all goods entering the USA from other countries are considered imports, customs clearance is necessary for all imports goods. The American Customs and Border Protection(CBP) will approve them entry when you provide right customs paperwork. Usually, you should provide right customs paperwork includes CI(Commercial Invoice), PL(Package List), EIN or SSN (both from IRS), ISF, BL and so on.

The US Customs states the following:

”The appropriate identification number for the Ultimate Consignee is an Internal Revenue Service employer identification number if a Social Security number. If the appropriate Ultimate Consignee identification number is not provided at the time of entry or release, entry of the merchandise shall be denied.”

It’s very clear that without an IRS number, CBP won’t allow the merchandises into the USA.

Where and how can I get an IRS number?

Every US citizen owns SSN from IRS. But most of people don’t want to use his/her own SSN for importing. If you own your business for importing, then you have to obtain an EIN number for your international business.

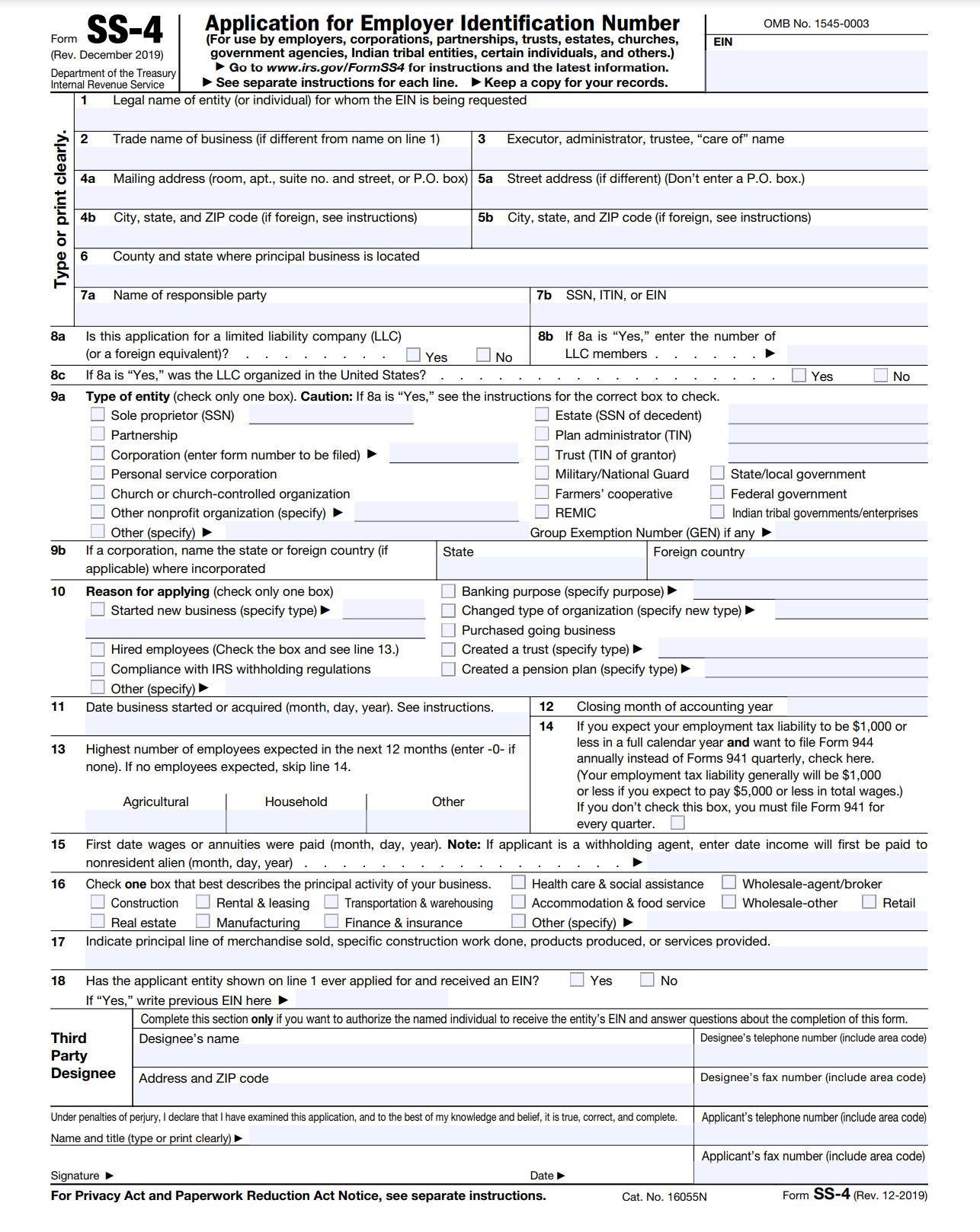

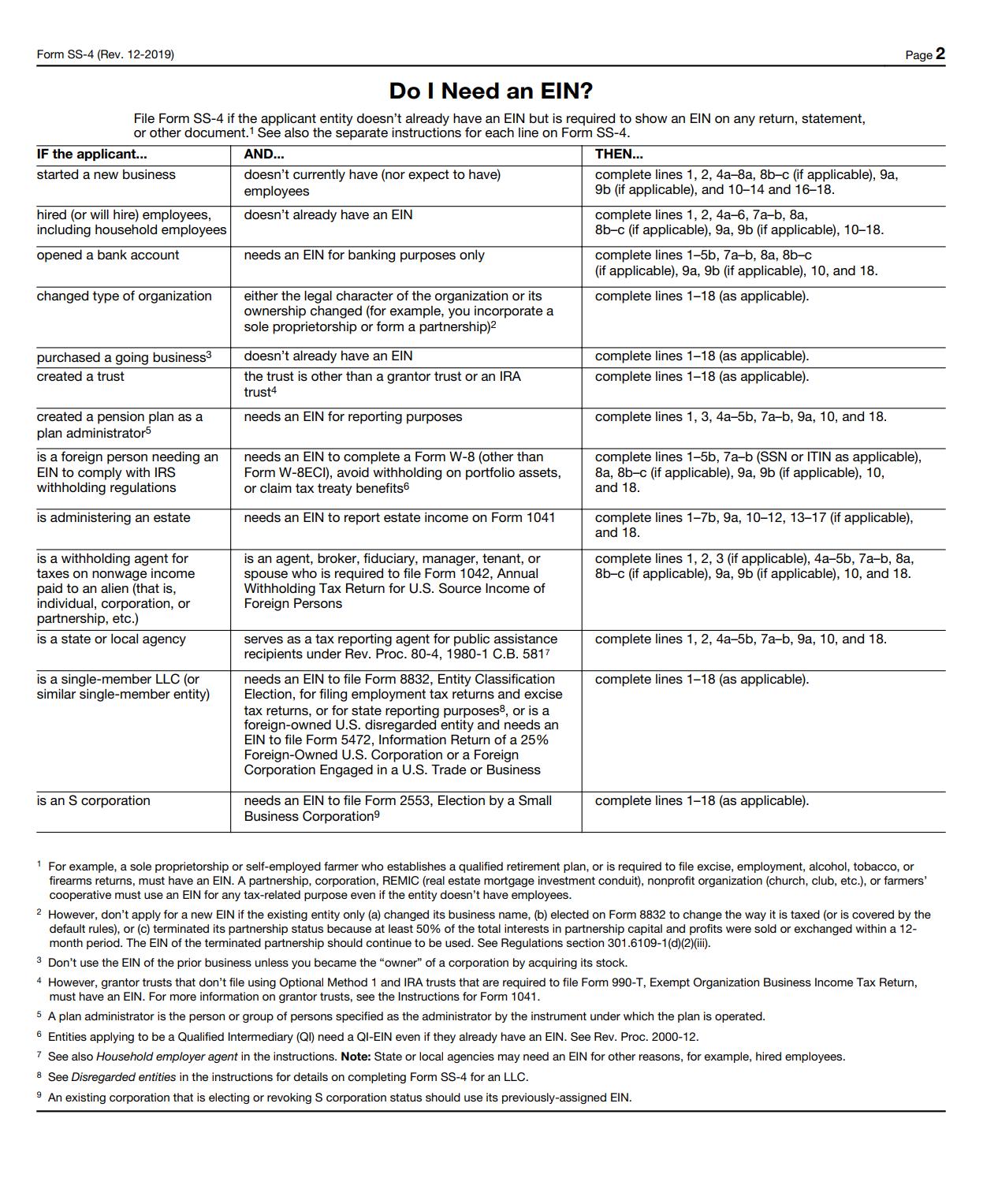

Method 1: Fill out the Form SS-4, fax or mail to apply an EIN Number.

Method 2: Authorize an agent to call the IRS to apply an EIN number.

The number 267-941-1099 for the international bureau of IRS. Their work hours are 6:00 A.M. to 11:00 P.M(ET), Monday through Friday. If you authorize an agent and fax in your signature, if everything goes smoothly without any issue, you may get the EIN at the same day.

Method 3: Apply for an EIN Online.

If you have principal place of business in the USA and have a valid Taxpayer Identification Number, you can apply EIN number Online. Go to the IRS website at www.irs.gov/businesses and click on Employer ID Numbers.

· You may apply for an EIN online if your principal business is located in the US.

· The person applying online must have a valid Taxpayer Identification No. (SSN, ITIN, EIN).

· You are limited to one EIN per responsible party per day.

o The “responsible party” is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.

· You must complete this application in one session, as you will not be able to save and return at a later time.

· Your session will expire after 15 minutes of inactivity, and you will need to start over.

· After all validations are done you will get your EIN immediately upon completion. You can then download, save, and print your EIN confirmation notice.

It may help your importing business.

Hiring a freight forwarding will help you much more on the international shipping. And make your shipment goes much smoothly. As an experienced freight forwarding company, CUC has rich experience to handle your shipment from China to USA. We are welcome you to contact us at any times.

Global Commerce Flow: Shipping Goods from China to CanadaMarch 13, 2024In the context of the globalized economy, the circulation of goods has transcended geographical boundaries, and international trade has become a crucial engine for economic development. As a world man...view

Global Commerce Flow: Shipping Goods from China to CanadaMarch 13, 2024In the context of the globalized economy, the circulation of goods has transcended geographical boundaries, and international trade has become a crucial engine for economic development. As a world man...view Top 10 Freight Forwarders in ChinaAugust 2, 2024Navigating the logistics landscape in China can be challenging due to its vast network and complex regulations. Freight forwarders play a crucial role in managing shipping and logistics, ensuring smoo...view

Top 10 Freight Forwarders in ChinaAugust 2, 2024Navigating the logistics landscape in China can be challenging due to its vast network and complex regulations. Freight forwarders play a crucial role in managing shipping and logistics, ensuring smoo...view Shipping Cargoes By Ocean, Air, Or Multimodal Transport?June 27, 2023In today's globalized world, shipping cargoes across international borders has become essential for businesses of all sizes, and it requires a reliable and cost-effective transportation solution. ...view

Shipping Cargoes By Ocean, Air, Or Multimodal Transport?June 27, 2023In today's globalized world, shipping cargoes across international borders has become essential for businesses of all sizes, and it requires a reliable and cost-effective transportation solution. ...view National anti-dumping product inquiry guideSeptember 13, 2023Anti-Dumping Duty? What is it?When we comes to anti-Dumping, we need to know what dumping is first.Dumping is a process wherein a company exports a product at a price that is significantly lower than ...view

National anti-dumping product inquiry guideSeptember 13, 2023Anti-Dumping Duty? What is it?When we comes to anti-Dumping, we need to know what dumping is first.Dumping is a process wherein a company exports a product at a price that is significantly lower than ...view